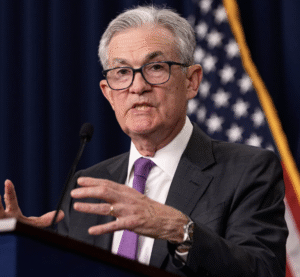

Donald Trump has consistently criticized Federal Reserve Chair Jerome Powell, openly stating that Jerome Powell Termination “cannot come soon enough.” These sharp criticisms raise questions about the Fed’s independence and the potential for political interference in monetary policy.

Trump’s Frustration with Federal Reserve Policies

Trump’s remarks came shortly after Powell voiced concerns about Trump’s tariff policies. Powell suggested these tariffs would likely increase inflation and slow economic growth, prompting the Fed to possibly approach interest rates with restraint.

In response, Trump took to Truth Social, blasting Powell and the Fed. He insisted that Powell should “certainly lower” interest rates, further fueling the ongoing tension between the White House and the central bank.

A History of Conflict

Throughout his presidency, Trump frequently criticized Powell, breaking with the long-standing tradition of respecting the Fed’s political independence. This sentiment mirrored his repeated criticisms during his first term, creating an environment of uncertainty around the Fed’s leadership.

Stagflation Concerns

Powell previously raised the specter of “stagflation,” a situation where inflation rises while the economy slows. Experts told ABC News that if the Fed raises interest rates to combat tariff-induced inflation, it could stifle borrowing and further damage the economy. Conversely, lowering rates to stimulate the economy could worsen inflation.

Trump’s Consistent Calls for Lower Interest Rates

In the months leading up to his more recent statements, Trump repeatedly called for lower interest rates. Even after the Fed chose to hold rates steady, Trump continued to urge them to reduce borrowing costs.

Powell’s Defiant Stance

Despite the pressure from the White House, Powell remained steadfast in his commitment to the Fed’s independence. In response to questions about his potential resignation if asked by Trump, Powell gave a firm “No,” emphasizing that his removal was “not permitted under the law.”

The Federal Reserve Act and Independence

The Federal Reserve Act of 1913 granted the central bank a degree of independence from the White House, aiming to insulate monetary policy from political influence. However, federal law allows the president to remove a Federal Reserve governor, including the Fed chair, “for cause.”

Legal Ambiguity Surrounding Removal

Experts suggest that while the president can remove a Fed chair “for cause,” the definition of what constitutes sufficient cause is ambiguous. A mere policy dispute would likely not meet the legal standard for removal.

Key Takeaways

Trump’s eagerness for Jerome Powell Termination highlights the ongoing tension between the White House and the Federal Reserve. Despite the Fed’s intended independence, the president’s repeated criticisms underscore the potential for political pressure on monetary policy. The legal ambiguities surrounding the removal of a Fed chair add further complexity to the situation.

In conclusion, the calls for Jerome Powell Termination reflect a persistent challenge to the Fed’s independence, raising critical questions about the future of monetary policy and the balance of power between the executive branch and the central bank.