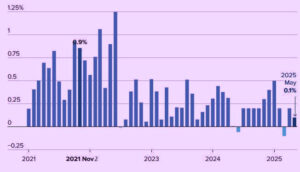

Consumer prices in the U.S. rose less than expected in May 2025, offering a temporary sigh of relief for markets, households, and policymakers alike. According to the latest May CPI inflation report released by the Bureau of Labor Statistics (BLS), the Consumer Price Index (CPI) increased by just 0.1% month-over-month, and the annual inflation rate stood at 2.4%, slightly below forecasts.

Core CPI, which excludes food and energy prices and is closely watched by the Federal Reserve, also rose 0.1% for the month, bringing the annual core inflation rate to 2.8%. These numbers came in below Dow Jones estimates of 0.2% and 2.9%, respectively, for headline and core CPI.

Source: Bureau of Labor Statistics

Despite recent tariffs imposed by President Donald Trump, inflation has not surged, as many economists previously feared. Energy prices declined by 1% and gasoline prices dropped by 2.6%, contributing significantly to the subdued CPI data. Vehicle and apparel prices also fell. Meanwhile, food and shelter prices increased modestly, with shelter being the primary driver of the overall monthly rise.

What the May 2025 CPI Report Means for Inflation Outlook

The May CPI inflation data indicates that the immediate impact of Trump’s tariff regime may be muted—at least for now. Analysts believe that the subdued price increases are partially due to businesses relying on existing inventories and being cautious in adjusting prices amid uncertain demand.

Seema Shah, Chief Global Strategist at Principal Asset Management, noted, “Today’s below forecast inflation print is reassuring – but only to an extent. Tariff-driven price increases may not feed through to the CPI data for a few more months yet.”

The 2.4% annual inflation rate marks only a slight uptick from April, while the 2.8% core inflation remains unchanged. Shelter costs, although still rising, are growing at their slowest pace (3.9%) since late 2021. The Trump tariffs, which include a 10% duty on all U.S. imports and reciprocal tariffs on other nations, have yet to show a substantial inflationary impact. However, experts caution that as inventories deplete and new pricing structures kick in, the real effects may show up later in the summer.

Complicating the inflation picture is a hiring freeze at the BLS, which has led to reduced data collection in some U.S. cities and an increased reliance on imputation models. Though the BLS insists this will not drastically affect the national CPI, analysts from BNP Paribas warned that smaller sample sizes could introduce more volatility in future readings.

Will the Fed Cut Rates in 2025 After May CPI Report?

The modest US inflation data from May 2025 has reignited the debate on whether the Federal Reserve should proceed with a rate cut. While the inflation numbers are not high enough to warrant further hikes, they also might not be low enough to justify an immediate cut.

Market analysts believe that the Federal Reserve interest rate decision is likely to be postponed until at least September, as the central bank continues to monitor the economic impact of ongoing trade tensions and the potential lagged effect of tariffs on consumer prices.

President Trump and Vice President JD Vance have been vocal about urging the Fed to lower rates. Vance called the Fed’s reluctance to cut interest rates “monetary malpractice” in a recent post on X.

The labor market has also shown early signs of cooling, adding pressure on the Fed to consider accommodative measures. However, for now, the central bank appears to be in “wait and watch” mode, giving itself time to assess whether the tariff-driven inflation shock materializes in the coming months.

The financial markets responded positively to the CPI news: stock futures rose, and Treasury yields fell, indicating investor confidence that inflation is under control, at least temporarily.

How Crypto Market Reacts to May CPI and Fed Rate Outlook

The cryptocurrency market closely watches inflation data and interest rate cues, as both significantly impact Bitcoin and altcoin price movements. The lower-than-expected May CPI inflation report and a possible delay in Fed rate cuts have brought mixed signals to the digital asset world.

Historically, lower inflation and looser monetary policy benefit cryptocurrencies by increasing liquidity and reducing the opportunity cost of holding non-yielding assets like Bitcoin. While this month’s data has not triggered immediate Fed action, it has kept the door open for a rate cut later in the year—a scenario that crypto investors generally favor.

In the hours following the CPI release, major cryptocurrencies saw mild upward movement, with Bitcoin (BTC) and Ethereum (ETH) gaining modestly. However, the crypto market reaction to inflation data has remained cautious. Traders appear to be waiting for clearer signals from the Federal Reserve.

If the Federal Reserve signals a rate cut in September, it could spark a more robust rally in the crypto space. Lower interest rates typically weaken the dollar and drive demand toward alternative assets, including crypto. Until then, price movements are expected to remain relatively range-bound.

Conclusion: Relief Now, Uncertainty Ahead

The May 2025 CPI inflation report provided a moment of calm amid turbulent economic policy and market speculation. Prices rose less than expected, signaling that tariffs haven’t yet caused runaway inflation. Still, as supply chains adapt and inventories deplete, the full impact of Trump’s tariffs could show up in the months ahead.

The Federal Reserve, under pressure from both data and political voices, is likely to tread carefully. While a rate cut isn’t imminent, the conversation is far from over. As for the crypto market, its near-term fate is tied to how inflation evolves and how the Fed responds in its next meetings.

For now, inflation is soft, markets are steady, and all eyes are on the next CPI report and the Fed’s September decision.

Justin Grant doesn’t just write news—he cuts through the noise. With 15+ years in journalism and content strategy, Justin has reported across industries, challenged narratives, and built stories that stick.